Payroll Giving

Help improve life after brain injury every time you’re paid.

Payroll Giving, also known as Give As You Earn, is the most convenient and tax-efficient way to make a regular donation to charity.

With Payroll Giving you can donate to Headway straight from your gross salary, before tax is deducted, so we receive more money at no extra cost to you.

Anyone who pays UK tax through PAYE can donate through Payroll Giving.

How much can you donate?

If you choose to donate through Payroll Giving, you have full control over how much you give to Headway.

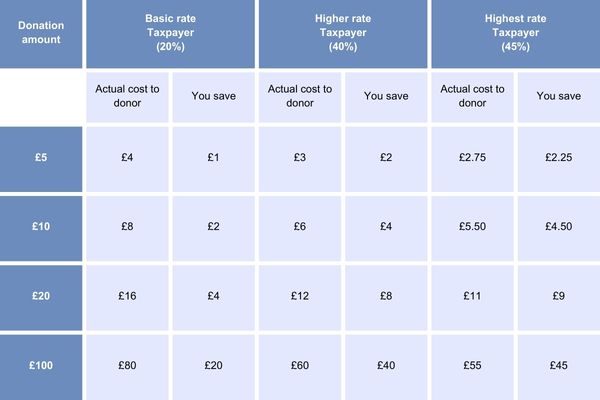

If you pay the basic 20% tax rate, for every £1.00 that you earn, 20p is paid in tax.

That means if you pledge £10.00 to Headway each month, we will receive the full amount, but only £8.00 will be deducted from your net pay.

If you pay income tax at the 40% rate, only £6.00 will be deducted, and at the highest rate of 45%, only £5.50 will be deducted.

The process for setting up Payroll Giving

1. Check with your employer to ensure your company offers Payroll Giving (if they do they will arrange your donation through your salary for you)

2. If your employer does not currently offer Payroll Giving, you can write to them and encourage them to set up a Payroll Giving scheme (your company will need to register with an approved Payroll Giving Agency^)

3. If your circumstances change and you want to cancel or change your donation at any time, simply tell your employer

4. If you change your job, your donations will not be transferred to your new employer and you will need to ensure your new company is registered with a Payroll Giving Agency

5. Alternatively, if you retire, you can set up a regular direct debit to Headway to replace the gift

*PGA examples: CAF, Charities Trust, Benevity

Received a little boost to your salary? Make the NI cut count!

The 2p National Insurance cut means some people received a little boost in last month's salary. If you're one of the lucky ones to benefit, why not sign up to Payroll Giving and send the difference to Headway each month? It's an easy way to donate, and it puts the tax cut to use improving life after brain injury.

For Employers

Payroll Giving is an easy way to engage employees and boost your employee benefits package.

It’s an attractive addition to your corporate social responsibility programme and enables you to measure the level of charitable giving that your company has helped achieve.

You can add even more value and show your commitment to supporting charitable causes by agreeing to match-fund employee donations to Headway.

For a set time to kick-start your scheme or even on a permanent basis, you can choose to single, double or even triple-match each donation made by your employees.

If you prefer to send a cheque in the post, please make this payable to ‘Headway – the brain injury association’ and send to the following address:

Headway – the brain injury association (Payroll Giving)

Bradbury House

Old Basford

Nottingham

NG6 8SF

What your Payroll Giving donation means to our work

Your support powers our services. Every pound donated will help brain injury survivors, their families and carers access support.

For more information please email Corporate Partnerships Manager, Amber Perry.

Fundraise for us

Your support powers our services. Every pound raised will help brain injury survivors, their families and carers access support.

Find out more